Navigating the Healthcare Landscape: Exploring the Use of HSAs for Skin Care Products

Related Articles: Navigating the Healthcare Landscape: Exploring the Use of HSAs for Skin Care Products

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Healthcare Landscape: Exploring the Use of HSAs for Skin Care Products. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Healthcare Landscape: Exploring the Use of HSAs for Skin Care Products

The Health Savings Account (HSA) has become a popular tool for individuals seeking to manage their healthcare expenses. While primarily designed for medical expenses, the question arises: can these funds be used for skin care products? This article aims to provide a comprehensive understanding of HSA eligibility for skin care, outlining the complexities and nuances involved.

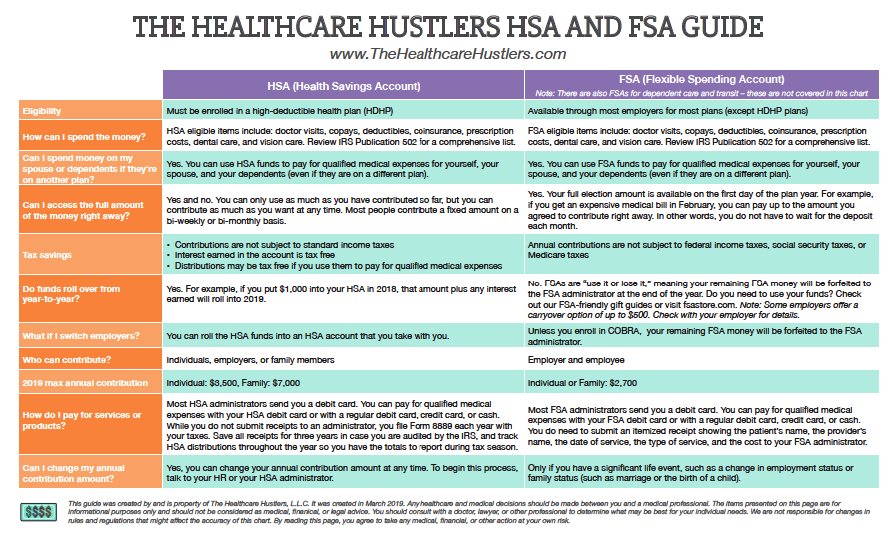

Understanding the HSA: A Financial Tool for Healthcare

An HSA is a tax-advantaged savings account specifically for healthcare expenses. Individuals with high-deductible health insurance plans are eligible to open an HSA, allowing them to contribute pre-tax dollars and withdraw these funds tax-free for qualifying medical expenses. This makes HSAs a powerful tool for managing healthcare costs, particularly for those with chronic health conditions or predictable medical needs.

The Delicate Balance: Determining HSA Eligibility for Skin Care

The crux of the matter lies in defining what constitutes a "qualifying medical expense" under HSA guidelines. The Internal Revenue Service (IRS) provides clear guidance on this, stating that expenses must be "incurred for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body." This broad definition leaves room for interpretation when it comes to skin care products.

The Spectrum of Skin Care: Navigating the Line Between Medical and Cosmetic

The distinction between medically necessary and purely cosmetic skin care products is crucial in determining HSA eligibility. Products used to treat diagnosed skin conditions, such as eczema, psoriasis, or acne, generally fall under the umbrella of qualifying medical expenses. However, products intended solely for aesthetic enhancement, such as anti-aging creams or wrinkle reducers, are typically considered ineligible.

Navigating the Gray Areas: Common Skin Care Products and HSA Eligibility

The line between medical and cosmetic skin care becomes blurred when considering products with dual functionalities. For instance, sunscreen, often used for sun protection, can also be prescribed for certain skin conditions like lupus or rosacea. In such cases, documentation from a healthcare professional is often required to justify HSA use.

The Importance of Documentation: Supporting Your HSA Claims

To ensure successful HSA claims, it is crucial to maintain thorough documentation. This includes:

- Prescriptions: For products specifically prescribed by a doctor for a diagnosed skin condition, a valid prescription is essential.

- Diagnosis: Documentation of the specific skin condition being treated is necessary to support the medical necessity of the purchase.

- Product Information: Provide detailed information about the product, including its intended use and active ingredients.

- Receipts: Keep all receipts for purchases made with HSA funds.

FAQs: Addressing Common Queries About HSA Use for Skin Care

Q: Can I use my HSA for over-the-counter (OTC) skin care products?

A: While some OTC products may be eligible, it is essential to ensure they are used for a diagnosed medical condition and supported by documentation from a healthcare professional.

Q: Can I use my HSA for laser treatments or cosmetic surgery?

A: Generally, these procedures are considered cosmetic and ineligible for HSA use unless medically necessary, such as for reconstructive surgery following an accident.

Q: What if my skin care product has both medical and cosmetic benefits?

A: Documentation from your doctor outlining the medical necessity of the product is crucial for supporting HSA eligibility.

Q: Can I use my HSA for skincare consultations with a dermatologist?

A: Yes, consultations with a dermatologist for diagnosis and treatment of skin conditions are generally considered qualifying medical expenses.

Tips for Maximizing HSA Use for Skin Care

- Consult with your doctor: Discuss your skin concerns with a healthcare professional to determine if your needs warrant medically necessary products.

- Maintain thorough documentation: Keep all prescriptions, diagnosis records, and receipts for future reference.

- Stay informed about HSA guidelines: Regularly review IRS guidelines and updates regarding eligible medical expenses.

- Consider a Flexible Spending Account (FSA): For expenses that may not qualify for HSA use, an FSA can provide alternative tax-advantaged savings.

Conclusion: Navigating the Complexities of HSA Eligibility for Skin Care

The use of HSAs for skin care products can be a complex and nuanced process. By understanding the distinction between medical and cosmetic treatments, maintaining proper documentation, and seeking guidance from healthcare professionals, individuals can maximize their HSA benefits for legitimate skin care needs. It is crucial to remember that HSA eligibility is subject to ongoing interpretation and updates by the IRS. Therefore, staying informed and seeking professional advice is essential for navigating this evolving landscape effectively.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Healthcare Landscape: Exploring the Use of HSAs for Skin Care Products. We thank you for taking the time to read this article. See you in our next article!