Navigating the Intersection of Cosmetic Procedures and Flexible Spending Accounts: A Comprehensive Guide

Related Articles: Navigating the Intersection of Cosmetic Procedures and Flexible Spending Accounts: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Intersection of Cosmetic Procedures and Flexible Spending Accounts: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Intersection of Cosmetic Procedures and Flexible Spending Accounts: A Comprehensive Guide

The allure of cosmetic procedures is undeniable, promising enhancements to one’s appearance and a boost in self-confidence. However, the financial burden associated with these procedures can be significant, prompting individuals to explore avenues for cost mitigation. One such avenue, often considered, is the Flexible Spending Account (FSA). While the concept of using an FSA for cosmetic procedures seems appealing, the reality is more nuanced, governed by a complex interplay of regulations, interpretations, and individual circumstances. This article aims to provide a comprehensive understanding of the use of FSAs for cosmetic procedures, shedding light on the intricacies and potential pitfalls.

Understanding the FSA Landscape

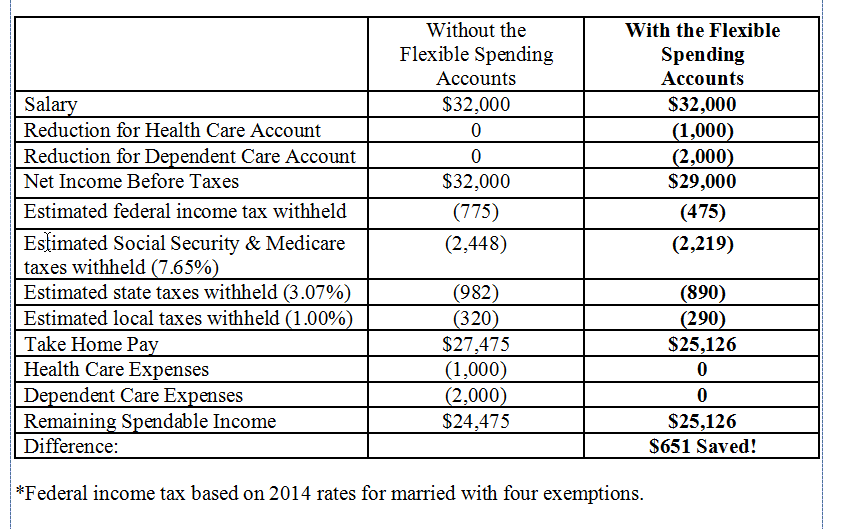

An FSA is a tax-advantaged savings account that allows individuals to set aside pre-tax income to cover eligible healthcare expenses. These expenses are typically defined as those deemed medically necessary by a healthcare provider. This definition is crucial when considering cosmetic procedures, as they are often perceived as elective and not medically necessary.

The Crucial Distinction: Medical Necessity

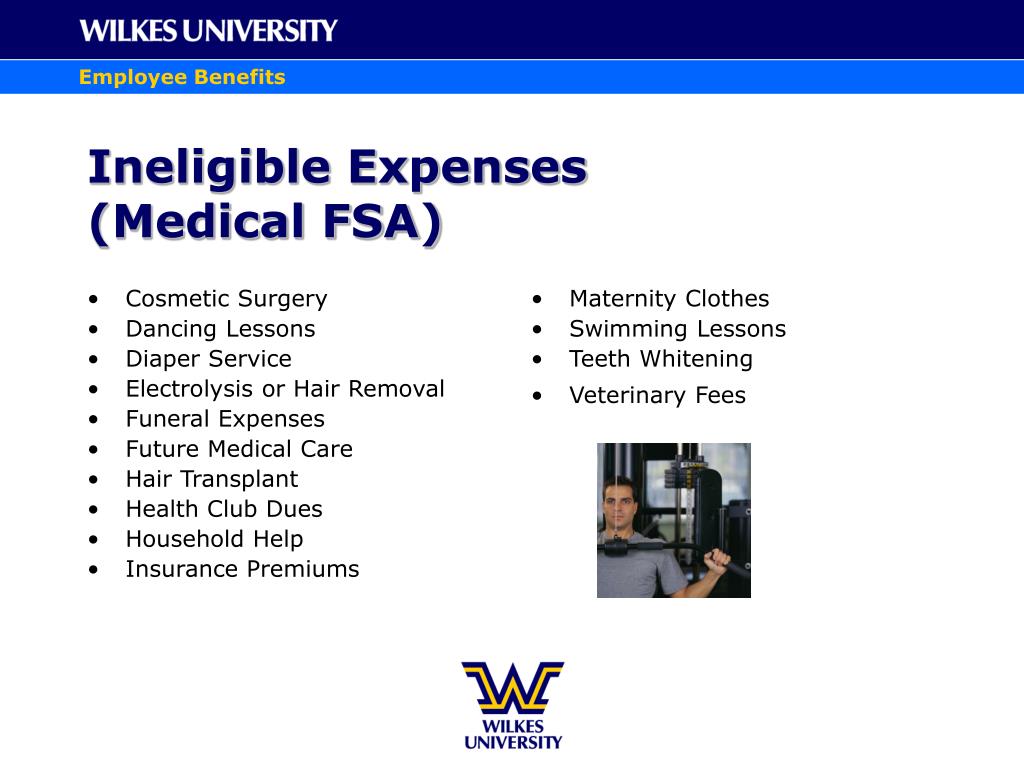

The crux of the issue lies in the interpretation of "medical necessity." While the IRS does not explicitly prohibit the use of FSAs for cosmetic procedures, the general understanding is that these procedures are not typically considered medically necessary. This interpretation stems from the fact that cosmetic procedures are primarily aimed at enhancing appearance rather than treating a medical condition.

Exceptions to the Rule: When Cosmetic Procedures May Be Eligible

There are specific instances where cosmetic procedures may be considered medically necessary and thus eligible for FSA reimbursement. These exceptions are typically related to conditions that impact an individual’s physical or mental health, such as:

- Reconstructive Surgery: Procedures performed to correct deformities resulting from accidents, birth defects, or previous surgeries can be eligible for FSA reimbursement.

- Treatment of Medical Conditions: Cosmetic procedures undertaken to address certain medical conditions, such as alopecia (hair loss) or severe acne, may be eligible for FSA reimbursement.

- Gender Affirmation Procedures: Procedures performed to align an individual’s physical appearance with their gender identity may be considered medically necessary and eligible for FSA reimbursement.

Navigating the Gray Areas: Documentation and Evidence

When seeking FSA reimbursement for a cosmetic procedure, individuals must provide substantial documentation to demonstrate medical necessity. This documentation typically includes:

- Physician’s Documentation: A detailed report from a qualified healthcare provider outlining the medical condition necessitating the procedure, its impact on the individual’s health, and the specific benefits of the procedure.

- Medical Records: Supporting documentation, such as medical records, laboratory results, or previous treatment records, that corroborate the physician’s report.

- Insurance Pre-authorization: In some cases, pre-authorization from the individual’s health insurance provider for the procedure may be required.

The Potential Risks of Utilizing an FSA for Cosmetic Procedures

While the possibility of utilizing an FSA for cosmetic procedures exists, it comes with inherent risks. These risks include:

- Audits and Penalties: The IRS may conduct audits to ensure the proper use of FSAs. If a cosmetic procedure is deemed ineligible for reimbursement, the individual may face penalties, including taxes and interest on the amount reimbursed.

- FSA Plan Restrictions: Individual FSA plans may have specific restrictions on the types of procedures eligible for reimbursement. It is crucial to review the plan documents carefully before undergoing any procedure.

- Denial of Reimbursement: Even with proper documentation, FSA administrators may deny reimbursement if they deem the procedure ineligible.

FAQs: Addressing Common Questions

1. Can I use my FSA for a facelift?

Generally, a facelift is considered an elective procedure and not medically necessary. However, if the facelift is performed to correct a medical condition, such as a facial nerve injury or a severe skin condition, it may be eligible for FSA reimbursement.

2. Can I use my FSA for laser hair removal?

Laser hair removal is typically considered an elective procedure. However, if the hair removal is medically necessary to treat a condition like hirsutism (excessive hair growth), it may be eligible for FSA reimbursement.

3. Can I use my FSA for Botox injections?

Botox injections are generally considered cosmetic and not medically necessary. However, if the injections are used to treat a medical condition, such as migraines or muscle spasms, they may be eligible for FSA reimbursement.

4. What documentation do I need to support my claim for reimbursement?

You will need a detailed physician’s report outlining the medical condition necessitating the procedure, its impact on your health, and the specific benefits of the procedure. Supporting documentation, such as medical records, laboratory results, or previous treatment records, may also be required.

5. What are the potential penalties if my claim is denied?

If your claim is denied, you may be required to repay the reimbursed amount, plus taxes and interest. You may also face penalties from the IRS for improper use of your FSA.

Tips for Maximizing Your FSA for Cosmetic Procedures

- Consult with a Healthcare Provider: Discuss your options with a qualified healthcare provider to determine if your procedure meets the criteria for medical necessity.

- Review Your FSA Plan Documents: Carefully review your FSA plan documents to understand the specific procedures eligible for reimbursement.

- Gather Comprehensive Documentation: Collect all necessary documentation, including physician’s reports, medical records, and insurance pre-authorization, to support your claim.

- Seek Professional Advice: If you are unsure about the eligibility of your procedure, consult with a tax advisor or an FSA specialist for guidance.

Conclusion: A Balanced Perspective

Utilizing an FSA for cosmetic procedures is a complex issue with no easy answers. While the potential for cost savings exists, it is crucial to understand the limitations and risks involved. By thoroughly researching the regulations, consulting with healthcare professionals, and gathering comprehensive documentation, individuals can make informed decisions regarding their FSA usage for cosmetic procedures. Ultimately, the decision should be based on a careful assessment of the potential benefits and risks, ensuring that the procedure aligns with both medical necessity and personal financial considerations.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Intersection of Cosmetic Procedures and Flexible Spending Accounts: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!