Navigating the Use of Health Savings Accounts (HSAs) for Skincare Expenses: A Comprehensive Guide

Related Articles: Navigating the Use of Health Savings Accounts (HSAs) for Skincare Expenses: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Use of Health Savings Accounts (HSAs) for Skincare Expenses: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Use of Health Savings Accounts (HSAs) for Skincare Expenses: A Comprehensive Guide

- 2 Introduction

- 3 Navigating the Use of Health Savings Accounts (HSAs) for Skincare Expenses: A Comprehensive Guide

- 3.1 Understanding HSA Eligibility for Skincare Products

- 3.2 Navigating the Gray Areas: Key Considerations

- 3.3 Potential Benefits of Using HSAs for Skincare

- 3.4 Addressing Common Questions about HSAs and Skincare

- 3.5 Tips for Maximizing the Use of HSAs for Skincare

- 3.6 Conclusion

- 4 Closure

Navigating the Use of Health Savings Accounts (HSAs) for Skincare Expenses: A Comprehensive Guide

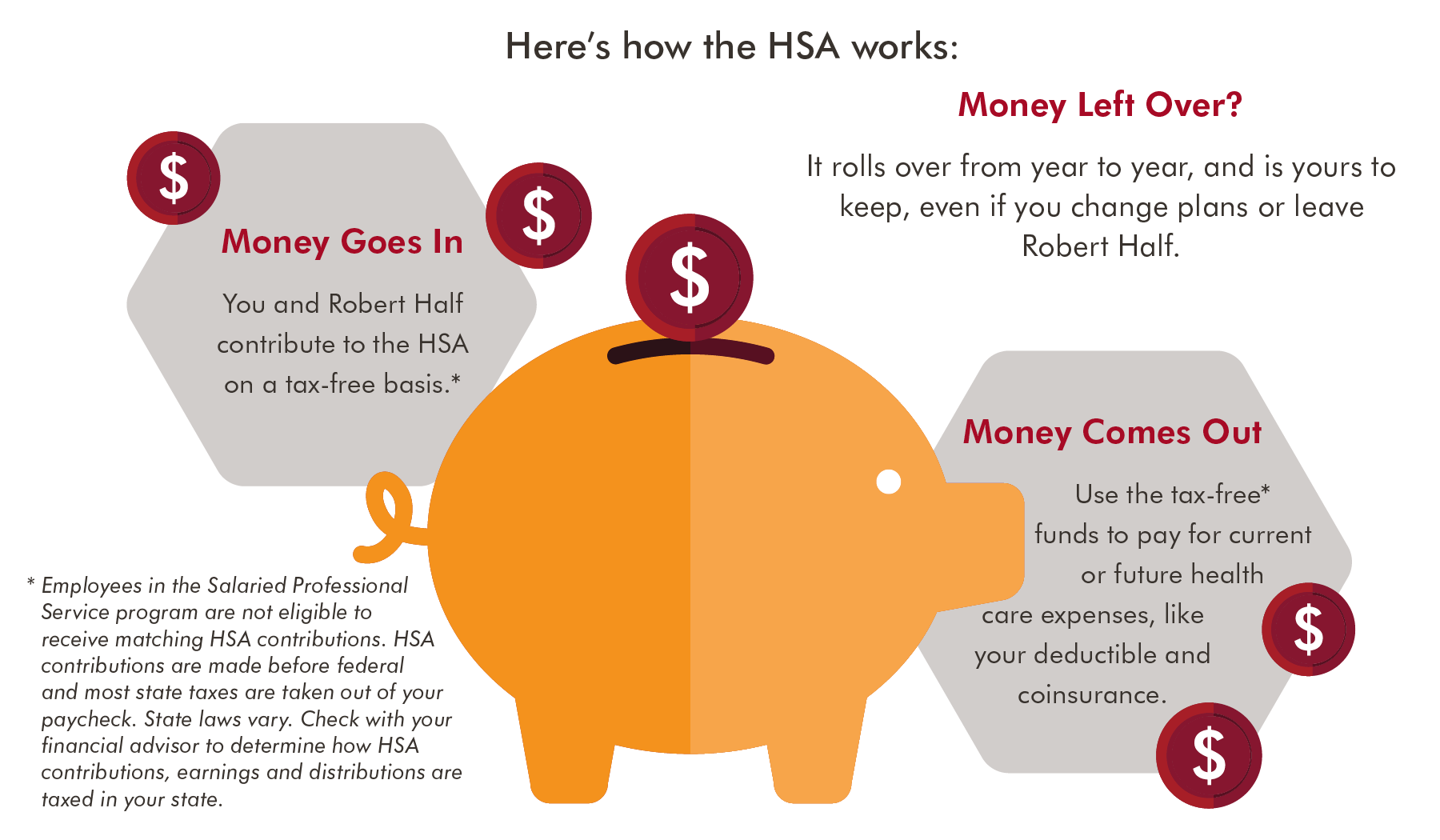

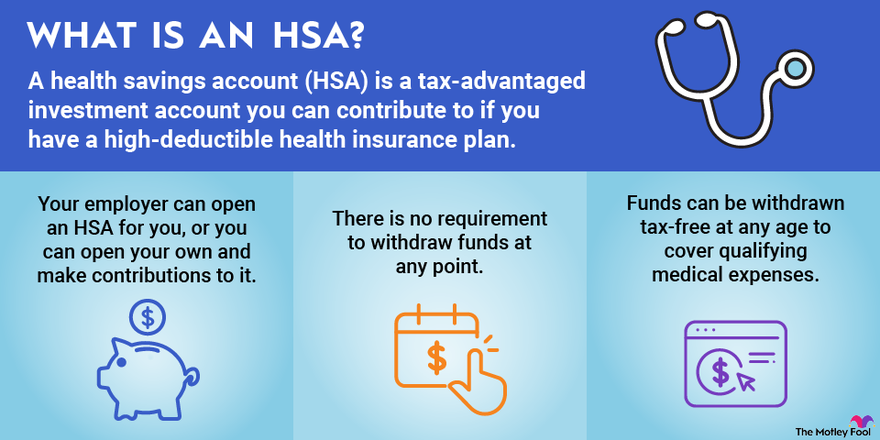

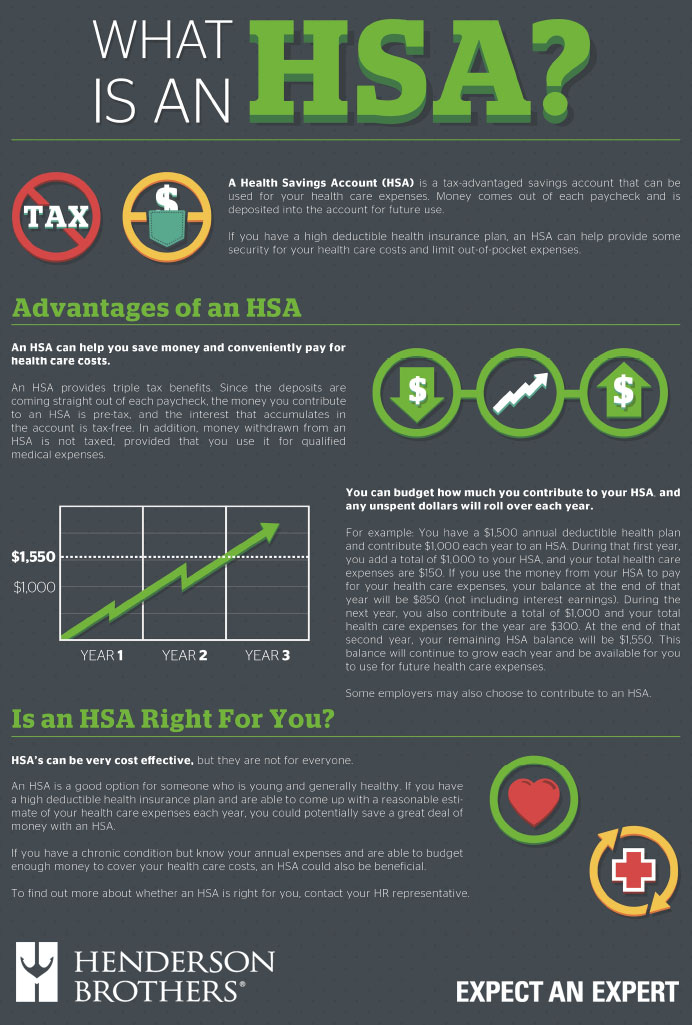

Health Savings Accounts (HSAs) offer a valuable tool for individuals seeking to manage their healthcare expenses. These tax-advantaged accounts allow individuals to set aside pre-tax dollars to pay for qualified medical expenses. However, the specific items eligible for HSA reimbursement can be a source of confusion, particularly when it comes to skincare products.

This article provides a detailed exploration of the complexities surrounding the use of HSAs for skincare expenses. It aims to clarify the eligibility criteria, highlight potential benefits, and address common questions regarding this topic.

Understanding HSA Eligibility for Skincare Products

The fundamental principle governing HSA eligibility centers around the notion of "medically necessary" expenses. This means that expenses must be incurred for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting the structure or function of the body.

In the context of skincare, the determination of medical necessity hinges on whether the product or service is primarily intended to address a medical condition rather than purely cosmetic concerns.

For example, a prescription topical cream for eczema, a product for acne treatment prescribed by a dermatologist, or a sunscreen recommended for a patient with photosensitivity due to a medical condition would likely be considered eligible for HSA reimbursement.

Conversely, products marketed solely for aesthetic purposes, such as anti-aging creams or wrinkle reducers, would generally not qualify for HSA funds.

Navigating the Gray Areas: Key Considerations

The line between medical necessity and cosmetic enhancement can be blurry. Several factors influence the determination of eligibility, including:

- Diagnosis and Prescription: Products prescribed by a licensed medical professional, such as a dermatologist, for a specific medical condition are more likely to be considered eligible.

- Product Purpose: The intended use of the product is crucial. Products marketed for the treatment of a medical condition, like psoriasis or rosacea, are more likely to be eligible than those marketed for general skin improvement.

- Documentation: Maintaining proper documentation, such as prescriptions, medical bills, and receipts, is essential for supporting HSA claims.

Potential Benefits of Using HSAs for Skincare

While not all skincare products qualify for HSA reimbursement, utilizing HSAs for eligible expenses can offer significant financial advantages:

- Tax Savings: Contributions to HSAs are made with pre-tax dollars, resulting in immediate tax savings.

- Investment Growth: Funds in an HSA can grow tax-free, allowing for potential long-term financial benefits.

- Flexibility: HSA funds can be used for a wide range of qualified medical expenses, including skincare, providing flexibility in managing healthcare costs.

Addressing Common Questions about HSAs and Skincare

1. Can I use my HSA for over-the-counter (OTC) skincare products?

While some OTC skincare products may be eligible for HSA reimbursement, it depends on the product’s intended use and medical necessity. Consult with your healthcare provider or HSA administrator to determine eligibility.

2. What documentation do I need to submit for HSA reimbursement of skincare expenses?

Typically, you will need to provide receipts, prescriptions (if applicable), and any other documentation that supports the medical necessity of the product or service.

3. What happens if my HSA claim for skincare is denied?

If your claim is denied, you may have the option to appeal the decision. It is advisable to contact your HSA administrator for guidance on the appeal process.

4. Are there any limitations on the amount I can spend on skincare with my HSA?

There is no specific limit on the amount you can spend on skincare with your HSA, but it is subject to the overall annual contribution limit for HSAs.

5. Can I use my HSA for cosmetic procedures like Botox or fillers?

Generally, cosmetic procedures are not eligible for HSA reimbursement, as they are considered elective and not medically necessary.

Tips for Maximizing the Use of HSAs for Skincare

- Consult with your healthcare provider: Discuss your skincare concerns and ask for recommendations for eligible products or treatments.

- Keep detailed records: Maintain receipts, prescriptions, and other documentation to support your HSA claims.

- Understand your HSA plan: Familiarize yourself with the specific rules and eligibility criteria of your HSA plan.

- Consider a flexible spending account (FSA): If you have an FSA, you may be able to use it for certain skincare expenses that are not eligible for HSA reimbursement.

Conclusion

Utilizing HSAs for eligible skincare expenses can be a valuable strategy for managing healthcare costs and maximizing financial benefits. By understanding the eligibility criteria, navigating the potential gray areas, and following the tips outlined in this article, individuals can make informed decisions about using their HSAs to address their skincare needs. Remember to consult with your healthcare provider and HSA administrator for specific guidance and to ensure compliance with all relevant regulations.

:max_bytes(150000):strip_icc()/Pros-and-cons-health-savings-account-hsa_final-32c82ecfb53340739b46e7bb0d13b18e.png)

%20FAQs_featured.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Use of Health Savings Accounts (HSAs) for Skincare Expenses: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!